Local Roads First FAQs

WHAT IS LOCAL ROADS FIRST?

Our Local Roads First: Roadmap to transportation independence comes from what are known as “Self-Help Counties”. These counties, twenty-five throughout California, have chosen to fund transportation projects and infrastructure improvements within their local communities by implementing local sales tax measures. These counties have taken the initiative to generate additional revenue specifically for transportation-related needs. Self Help Counties also gain greater access to grant funds From State and Federal entities.

WHAT WILL LOCAL ROADS FIRST ACCOMPLISH?

Becoming a Self Help County and putting Local Roads First would allow SLO County to be less reliant on State and Federal funding while still getting our fair share, complete projects such as filling potholes and decreasing areas of congestion in a timelier manner, and significantly decrease the amount of differed local projects.

WHAT WILL A TRANSPORTATION TAX COST?

The Local Roads First supplemental funding initiative would add a half-percent sales tax to every dollar spent within the county. All funds generated would be required to stay local and remain directly allocated to community transportation projects with 99% minimum going to improve transportation. In addition, jobs would be created, transit mobility increased, and and everyone, including residents and visitors to our region, would contribute to funding the roads we share.

How Does Local Roads First Help My Community?

As a Self Help County, Local Roads First ensures local funding collected stays in local communities

Local transportation infrastructure jobs will be created and maintained in SLO County

A half cent of every dollar will be allocated to local transportation funding

SLO County will win more tax dollars back from the state and federal government

What the Numbers Look Like

WHY IS MORE TRANSPORTATION FUNDING NEEDED NOW?

Our Local Roads First map to transportation independence comes from what are known as “Self-Help Counties”. These counties, twenty-five throughout California, representing nearly 90% of the population, have chosen to fund transportation projects and infrastructure improvements within their local communities by implementing local sales tax measures. These counties have taken the initiative to generate additional revenue guaranteed for transportation-related needs. Self Help Counties also gain greater access to match funding From State and Federal entities.

WHAT DOES TRANSPORTATION FUNDING LOOK LIKE AT A LOCAL LEVEL?

According to the 2023 Regional Transportation Plan (RTP), SLO County will need $5.4 billion in transportation infrastructure over the next twenty-three years, but only expects $3.1 billion in available funds. With a $2.3 billion projected deficit, basic transportation improvements such as fixing potholes, implementation of Safe Routes to School programs, and road and highway updates cannot be implemented.

$2.3 Billion

projected deficit over the next twenty-three years

$900 Million

additional funding brought in over a twenty-year duration if measure is approved

$5.4 Billion

projected transportation funding needed over the next twenty-three years

$1 Billion

estimated match funding won through state and federal grants if a measure is approved

$3.1 Billion

projected available federal, state, and local funding over the next twenty-three years

$1,400

estimated yearly auto repair cost to motorists Learn More

The 2023 RTP plans for and accommodates growth within SLO County over the next twenty-three years; in a manner that uses resources more efficiently, protects existing communities, improves safety, conserves farmland and open space, and supports the local economy. Staying within budget, The Plan is underfunded by $2.3 billion. Learn more about the 2023 Regional Transportation Plan.

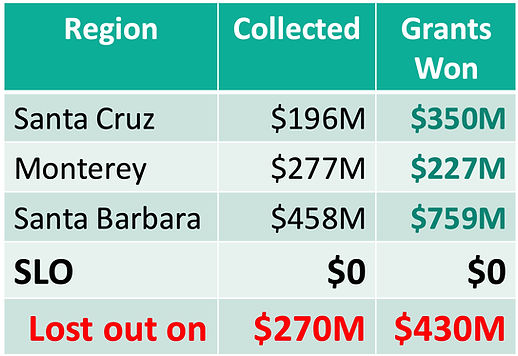

WHY IS SLO COUNTY GETTING LEFT BEHIND ON STATE AND FEDERAL TRANSPORTATION FUNDING?

Fewer tax dollars from State and Federal funding grants are returning to SLO County because the county is generating less revenue to match competitive grant funds. This lack of Federal and State funds is leaving SLO County behind while also allowing a disproportionate amount of tax revenue to be distributed to other counties throughout California.

The twenty-five counties in California that have approved a Self Help transportation tax ballot measure deliver more projects faster and cheaper than counties solely reliant on State and Federal funds.

What our Neighbors Have Invested and Leveraged (in grants) Since 2016

WHAT WILL A TRANSPORTATION TAX COST?

The Local Roads First supplemental funding initiative would add a half-percent sales tax to every dollar spent within the county. These funds would be required to stay local and remain directly allocated to community transportation projects. In addition, jobs would be created, transit mobility increased, and everyone, including residents and visitors to our region, would contribute to funding the roads we share.

$0.15 Tax Paid

on a $30 pair of shoes

$5.00 Tax Paid

on a $1,000 cellphone

$150.00 Tax Paid

on a $30,000 car

$2.31 per Week

estimated cost for individuals earning a $60,000 salary

How Can I Easily Explain Local Roads First?

LRF ensures local funding collected stays in local communities

A half cent of every dollar spent on taxable goods will be allocated to local transportation funding

LRF creates a direct tax for a direct result

LRF uses a half a penny to make infrastructure whole

More federal and state tax dollars will come back to the county through Competitive Grants

LRF means local funds are used for local priorities

Learn More: What is a Self Help County?

Self Help Counties refer to counties that have chosen to fund transportation projects and infrastructure improvements within their communities by implementing transportation-specific sales tax measures. These counties have taken the initiative to generate revenue allocated specifically for transportation-related needs.

To become a Self Help County, a Transportation-specific Sales Tax Measure (Local Roads First) must pass a two-thirds ballot vote to authorize the collection of a local sales tax. The revenue generated from these sales taxes is then dedicated to funding local transportation projects, such as road improvements, bike lanes, safety, pedestrian infrastructure, and other transportation-related initiatives.

By opting to become self-help counties, these jurisdictions demonstrate their commitment to addressing local transportation needs and taking direct responsibility for funding and implementing projects that benefit their communities. This approach allows counties to have more local control and flexibility over transportation planning and project prioritization, enabling tailored solutions to unique community needs and priorities.